Our Story

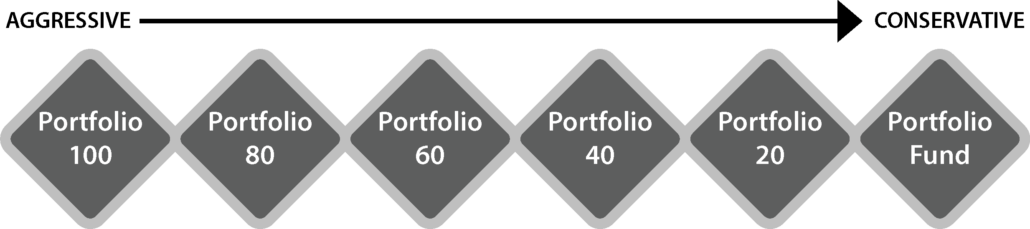

Born out of a local CPA firm, Wealth Management manages retirement plans as an investment fiduciary for Plan Sponsors and Advisors nationwide. Our focus is to help participants retire successfully. We choose appropriate investments for your retirement plan by utilizing our core, academic-based system – a smarter way to invest. This approach to investing has helped us reach over $1 Billion in assets under management. Our core philosophy centers around low-cost investments, broad diversification, a long-term perspective, and simplifying investing for participants through professionally managed model portfolios. Our collection of participant resources brings retirement readiness within reach.